If you have recently suffered any type of property damage, we know by vast experience that the entire process can be frustrating and stressful. That is why we do the fighting for you and it sometimes seems like a real fight dealing with the insurance company. Are you thinking about filing a property damage claim? If you are filing any kind of property damage claim, time is critical, and you must complete it FAST! Avoid a late reported damage claim and you will avoid a lot of stress!

Water Damage Property Claims

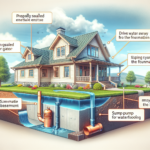

If you are filing any kind of water damage claim on your property, it is extremely important that you report it as you notice it happening, along with the proper cause of the damage. Why does a few days make all the difference? With water damage, there are many ways it can happen. This includes bad insulation, leaky roofs, burst pipes and, finally, flooding. Each insurance policy covers things differently, and insurance company claims adjusters are experienced at muddling the actual cause of the water damage, and making it look uncertain.

If your property was damaged by rain and you wait a week to report it and file a claim, insurance companies will find any way to take that water damage and speculate that it could be attributed to a number of things instead of the cause you specify. Policies may offer far less compensation for a burst pipe or a faulty sump pump versus a basement overcome by a storm flood. Insurance companies will do what they must, in order to save money. So, when water damage happens, report it immediately. Take pictures, get as much proof as possible and then hire an independent claims adjuster.

Property Damage Claims

These are another problem that need to be reported immediately. If you have been a victim of vandalism, it is important that you immediately file a police report and take a lot of pictures through whatever means possible. If you wait too long, or do not file a police report, insurance companies will see that as a dubious claim. If you do not properly report the property damage, it is anyone’s guess as to where that damage came from. It sounds ridiculous, but insurance company claims adjusters do what they need to, to stay employed.

Fire and Smoke Property Damage Claims

This is another very tricky claim to make. Fire damage is often contested as it can be difficult to pinpoint the cause or source of a fire. It could be faulty electricity, a kitchen fire or even fire caused by the negligence of a property’s occupant. When you are filing a claim for fire, you want your property looked at by a professional within 24-48 hours of the initial fire. Once you have filed a proper incident report with your local fire department or county, depending on your local laws, you need to hire an independent public claims adjuster so that your case is not pointed right back in your direction.

Do not Delay – File that Claim Fast!

Claims adjusters at insurance companies are sure to take advantage of a late claim report, regardless of how loyal of a policyholder you have been to their company. Report your incident immediately, get proper documentation and take lots of pictures. After all of that, contact us before filing anything!

About Community Public Adjusters

Community Public Adjusters specializes in homeowners and business insurance claim representation. Our public adjusters and property loss consultants work diligently to make sure you get the maximum possible settlement from the insurance company regarding your insurance claim.

We offer claim representation services on a contingency basis, if we do not collect any funds for you, we do not get paid at all. Community Public Adjusters has expert knowledge on how the insurance claim process works. We work with you on every step of the claims process.

We represent home and business owners and have vast experience with the following types of claims

- Fire and smoke damage claims

- Water damage claims

- Flood damage claims

- Theft and vandalism damage claims

- Snow and ice damage claims

- Building collapse claims

- Wind and hail damage claims

- Catastrophic damage claims

- Roof leaks

- Blown off shingles & siding

- All plumbing leaks

- Toilet overflow

- Burst Pipes

- Frozen Pipes