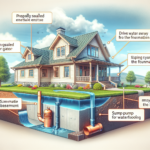

Water pipe bursts can cause significant damage to a property, leading to costly repairs and disruptions to daily life. Fortunately, homeowners insurance can provide coverage for the damage caused by a water pipe burst. In this blog, we’ll take a closer look at how insurance claims work for water pipe bursts and what steps you can take to ensure you receive the coverage you need.

When a water pipe bursts in your home, the damage can be extensive. The water can quickly spread throughout the property, damaging floors, walls, and furniture. The first step in the insurance claims process is to contact Community Public Adjusters as soon as possible. They will send out an adjuster to assess the damage and provide guidance on next steps.

It’s important to document the damage as thoroughly as possible. Take pictures and video of the affected areas, making note of any items that are damaged or destroyed. This will help ensure that you receive the appropriate compensation for the damage.

Your insurance policy may cover several types of damage that can result from a water pipe burst, including water damage, mold damage, and structural damage. However, it’s important to review your policy carefully to understand exactly what is covered. Some policies may exclude certain types of damage or have limits on the amount of coverage provided.

It’s also important to take steps to mitigate the damage as much as possible. This means stopping the flow of water if possible, drying out the affected areas, and removing any damaged items. Your insurance adjuster can provide guidance on the best way to do this.

When it comes to filing the insurance claim, your insurance company will likely require detailed information about the cause of the water pipe burst. This can include information about the age and condition of the pipe, as well as any maintenance or repairs that have been done in the past. Providing this information can help your insurance company determine the cause of the burst and determine whether or not the damage is covered by your policy.

Once your claim is approved, your insurance company will provide you with an estimate for the cost of repairs. This may include the cost of replacing damaged items, repairing structural damage, and removing any mold that may have developed. Depending on your policy, you may be responsible for paying a deductible before your insurance coverage kicks in.

In conclusion, water pipe bursts can cause significant damage to a property, but homeowners insurance can provide coverage for the resulting damage. It’s important to contact your insurance company as soon as possible and document the damage thoroughly. Review your policy carefully to understand exactly what is covered, and take steps to mitigate the damage as much as possible. By following these steps, you can ensure that you receive the appropriate coverage for the damage caused by a water pipe burst.

We represent home and business owners and have vast experience with the following types of claims

- Fire and smoke damage claims

- Water damage claims

- Flood damage claims

- Theft and vandalism damage claims

- Snow and ice damage claims

- Building collapse claims

- Wind and hail damage claims

- Catastrophic damage claims

- Roof leaks

- Blown off shingles & siding

- All plumbing leaks

- Toilet overflow

- Burst Pipes

- Frozen Pipes