Every insurance policy has its own set of limitations, exclusions and thresholds. These are known as triggers. Triggers are the pre-determined conditions that must be met for a claim to be paid. Understanding the triggers in your insurance policy means you’re aware of what you’re covered for and will prevent you from being unpleasantly surprised if something goes wrong. Even commonplace insurance policies have specific triggers, but there is no standard list: every insurance provider has their own list of triggers for their policies. Help is around the corner at communitypublicadjusters.com This article covers a selection of common triggers found in most insurance policies.

What is a smoke insurance claim?

Smoke insurance is a type of insurance covering fire damage to your home and its contents caused by a fire. It is one of the most common types of insurance claims, and the cost of smoke damage is often covered by your home insurance policy. If you have a fire in your home, you will make a smoke damage insurance claim to cover the cost of repairs and the contents of your home if they are damaged by the smoke. If your house is damaged by smoke, you will make a smoke damage insurance claim to cover the cost of repairs. If any of your belongings are damaged by smoke, you will make a smoke damage insurance claim to cover the cost of replacing your damaged items.

A fire insurance claim

A fire insurance claim is for damage caused due to a fire. This can include damage to your belongings and damage to any property you own, such as a rental property. Fire damage can happen in a variety of ways, both inside your home and outside. A fire insurance claim can only be made if the fire started on your property by accident. If your home is damaged by fire, you will make a fire insurance claim to cover the cost of damage to your home, including the structure of your home, the wiring and the plumbing. Fire damage can also cause damage to any belongings you have, including your furniture, appliances and valuables. If any of your belongings are damaged by fire, you will make a fire insurance claim to cover the cost of replacing your damaged items.

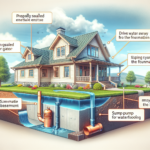

A water damage insurance claim

Water damage insurance is a type of insurance covering damage to your home caused by water. Water damage insurance is often included in a standard home insurance policy, so check your policy to see if this coverage is included. If it’s not, you can add it to your policy for a small additional cost. If your home is damaged by water, you will make a water damage insurance claim to cover the cost of repairs. If any of your belongings are damaged by water, you will make a water damage insurance claim to cover the cost of replacing your damaged items. If there is significant water damage in the area around your home, this can cause water to get into your home through your roof, walls or floor. If water gets into your home, it can damage your belongings and the inside of your home. If there is water damage in your home, you will make a water damage insurance claim to cover the cost of repairs.

Additional living expense insurance claim

An additional living expense insurance claim is for a loss incurred due to damage to your home or belongings. You may have an additional living expense claim if there is damage to your home or belongings that requires you to temporarily vacate your home. If you can’t live in your home due to damage, you will make an additional living expense claim. If you have an additional living expense claim, you will receive the money for living outside your home. If your home is damaged by a natural disaster, such a hurricane or wildfire, you may have to temporarily vacate your home. If you have to vacate your home due to damage, you will make an additional living expense insurance claim.

Food loss insurance claim

Food loss insurance is a type of insurance covering the cost of spoiled food. Food loss insurance is often included in a standard home insurance policy, so check your policy to see if this coverage is included. If it’s not, you can add it to your policy for a small additional cost. If your food is spoiled due to a natural disaster, such as a hurricane or wildfire, you will make a food loss insurance claim to cover the cost of your spoiled food. If a natural disaster damages your home, it can also damage your appliances, such as your refrigerator and freezer, which can cause your food to spoil. If your appliances are damaged by a natural disaster and your food spoils as a result, you will make a food loss insurance claim to cover the cost of your spoiled food. If a natural disaster damages your home and your food spoils as a result, you will make a food loss insurance claim to cover the cost of your spoiled food. Contact communitypublicadjusters.com for additional information.

Computer, TV and other household items insurance claim

Computer, TV and other household items insurance is a type of insurance covering the cost of damaged, lost or stolen household items. Household items insurance is often included in a standard home insurance policy, so check your policy to see if this coverage is included. If it’s not, you can add it to your policy for a small additional cost. If your household items are damaged, lost or stolen due to a natural disaster such as hurricane or wildfire, you will make a household items insurance claim to cover the cost of replacing your damaged or lost items. If a natural disaster damages your home, it can also damage your household items. If your household items are damaged by a natural disaster and you cannot repair or replace them, you will make a household items insurance claim to replace your damaged or lost items. If a natural disaster damages your home and your household items are damaged, lost or stolen as a result, you will make a household items insurance claim to replace your damaged or lost items.

Conclusion

Every insurance policy has its own set of limitations, exclusions and thresholds. These are known as triggers. Triggers are the pre-determined conditions that must be met for a claim to be paid. Understanding the triggers in your insurance policy means you’re aware of what you’re covered for and will prevent you from being unpleasantly surprised if something goes wrong. Even commonplace insurance policies have specific triggers, but there is no standard list: every insurance provider has their own list of triggers for their policies. This article covers a selection of common triggers found in most insurance policies.

We offer claim representation services on a contingency basis, if we do not collect any funds for you, we do not get paid at all. Community Public Adjusters have expert knowledge of how the insurance claim process works. We work with you on every step of the claims process.

We represent home and business owners and have vast experience with the following types of claims

- Fire and smoke damage claims

- Water damage claims

- Flood damage claims

- Theft and vandalism damage claims

- Snow and ice damage claims

- Building collapse claims

- Wind and hail damage claims

- Catastrophic damage claims

- Roof leaks

- Blown off shingles & siding

- All plumbing leaks

- Toilet overflow

- Burst Pipes

- Frozen Pipes